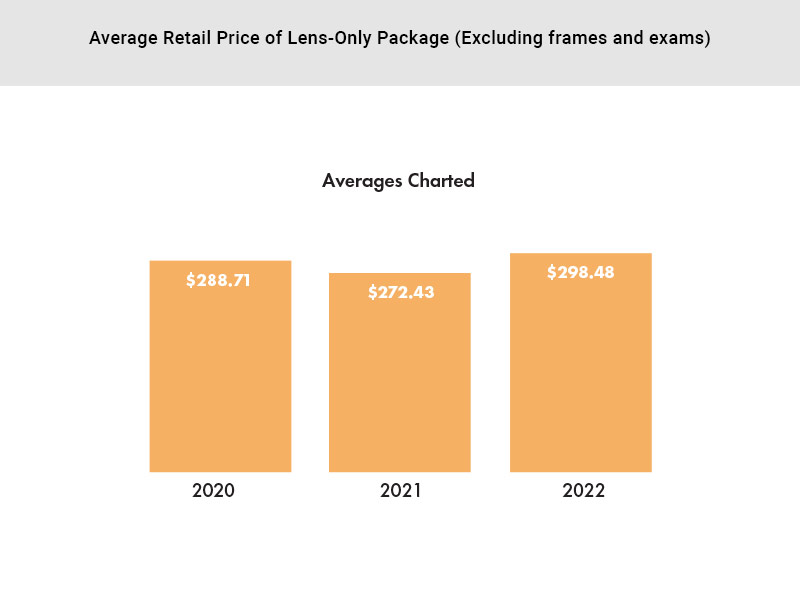

News flash! The price of lens-only packages (lenses and treatments) sold by independent eyecare practitioners is steadily increasing. That’s one of the key findings of L&T’s newly released annual Premium Lens MarketPulse Survey. The average price of a lens-only package was $298.48 in 2022, according to the survey, a significant increase from $272.43 in 2021 and $260.85 in 2019.

The results of L&T’s 2023 Premium Lens MarketPulse Survey are based on input from 289 independent optical retailers. These valuable statistics can help independent practitioners gauge how their sales of spectacle lenses and treatments, as well as other dispensing criteria, compared with their peers. These data points, along with other survey highlights, are featured in the following topline summary. For the complete survey results, contact Jennifer Waller, Director of Research & Business Analytics at [email protected].

–Andrew Karp

TOTAL SALES

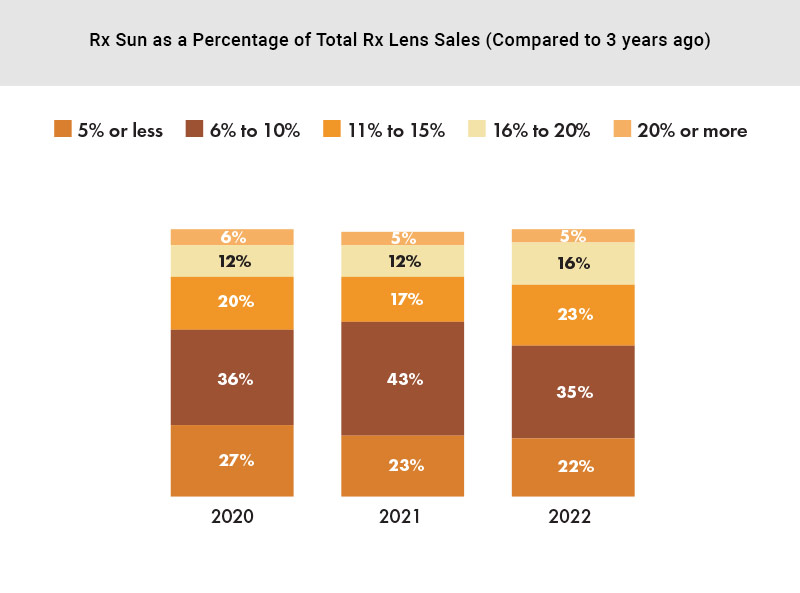

Compared to three years ago, 50 percent of retailers said that spectacle lenses and treatments made up a larger percentage of their location’s total gross dollar sales in 2022. In 2022, 69 percent said pricing on spectacle lenses and treatments has increased compared to three years ago as well, and 35 percent said that Rx sun lenses as a percentage of total dollar sales increased over the same period.

LENS SALES

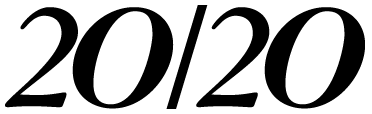

When asked to rank lens design by popularity, standard or aspheric single vision was ranked most popular by 42 percent of retailers. Customized or personalized progressives were ranked most popular by 36 percent.

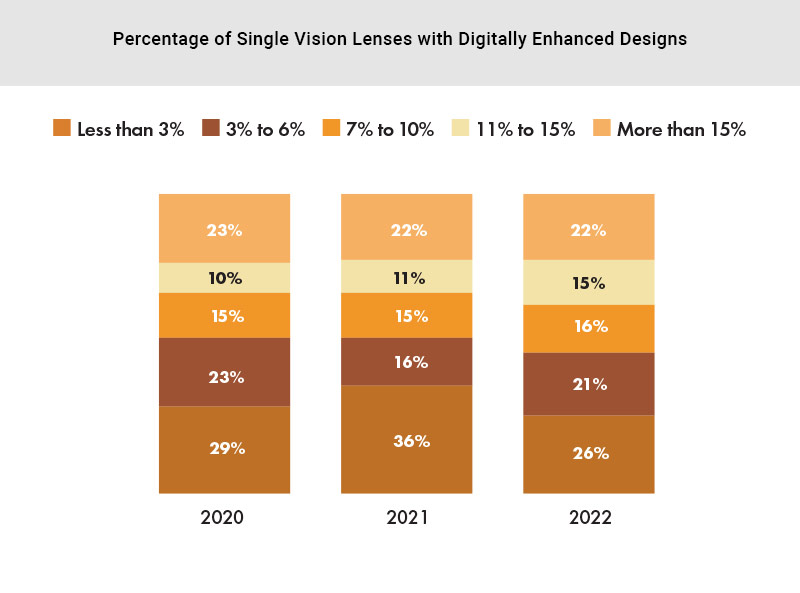

About one quarter (26 percent) said less than 3 percent of single vision Rxs sold are digitally enhanced.

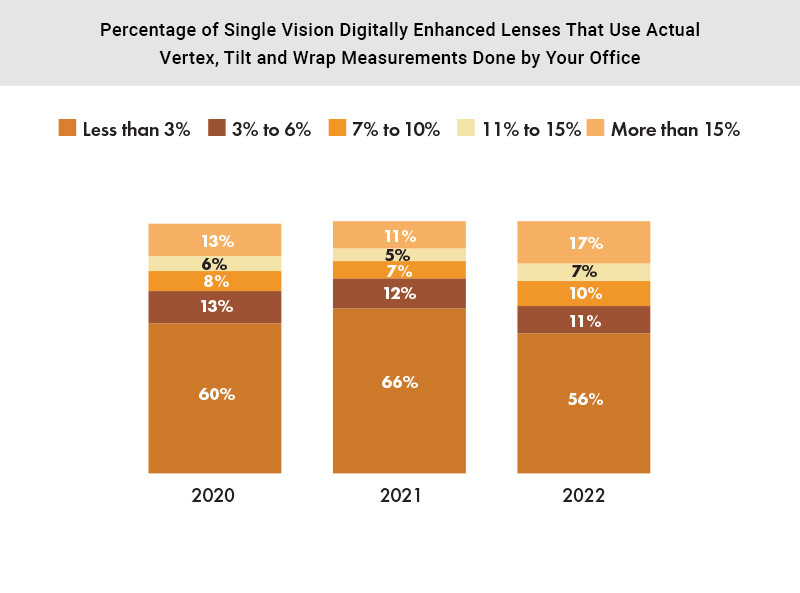

Over half of retailers (56 percent) said less than 3 percent of single vision digitally enhanced lenses use actual vertex, tilts and wrap measurements done in the office by the retailer.

Over half (59 percent) of retailers said that customized or personalized progressive lenses made up a greater proportion of their total lens sales in 2022 than they had versus three years ago, and half (49 percent) said computer/variable focus sales had increased over the last three years, while one third (34 percent) said that sales of bi/trifocals had decreased as a percentage of total lens sales over the last three years, respectively.

Seventy-six percent prefer lens manufacturer brands over lab private labels for digital progressive lenses.

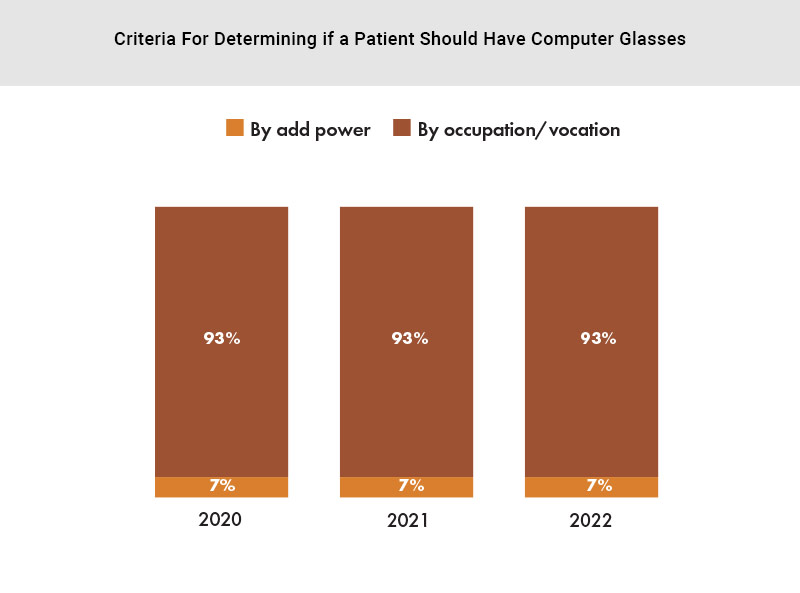

COMPUTER/OFFICE LENSES

Almost all retailers surveyed (93 percent) say they determine whether a patient should have computer lenses by their occupation/vocation as opposed to add power.

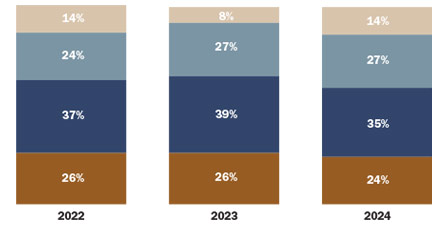

LENS MATERIALS

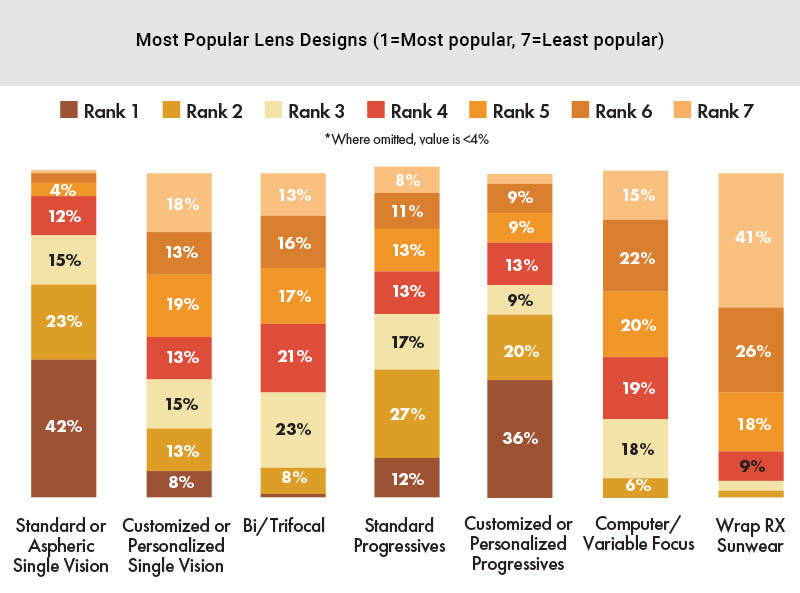

When asked to rank lens material by popularity, polycarbonate was ranked most popular by 48 percent of the retailers. Standard plastic was ranked most popular by 25 percent. Glass (1.52) was ranked least popular by the most retailers (48 percent), while Tribrid, the newest material, was ranked least popular by 47 percent.

Forty percent of retailers said that their 2021 polycarbonate lens sales increased as a proportion of total lens pair sales compared to one year ago. Thirty-nine percent and 36 percent said the same about their super high-index and Trivex lenses, respectively.

Sixty-four percent said that their mid-index lens sales had stayed flat. Glass was the weakest with 41 percent saying that glass made up a smaller proportion of their total lens sales in 2022 than last year.

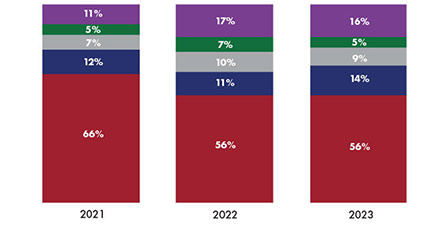

BLUE LIGHT FILTERS

An average of 46 percent of clear blue light filtering lenses are produced with blue light filtering AR coatings. For 19 percent, the blue filter is within the lens substrate (in-resin). Thirty-two percent are combinations of the two.

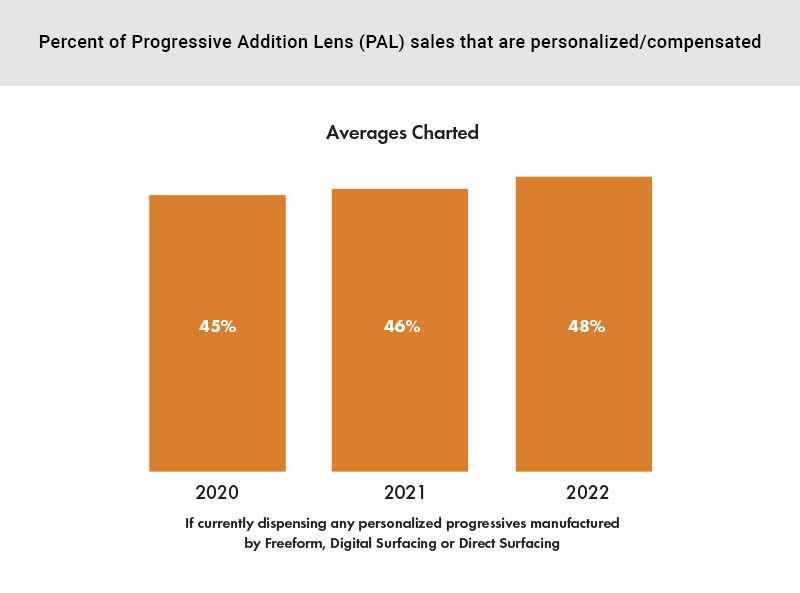

PERSONALIZED PROGRESSIVES

Retailers said that 48 percent of their progressive lens sales are personalized/compensated,

on average.

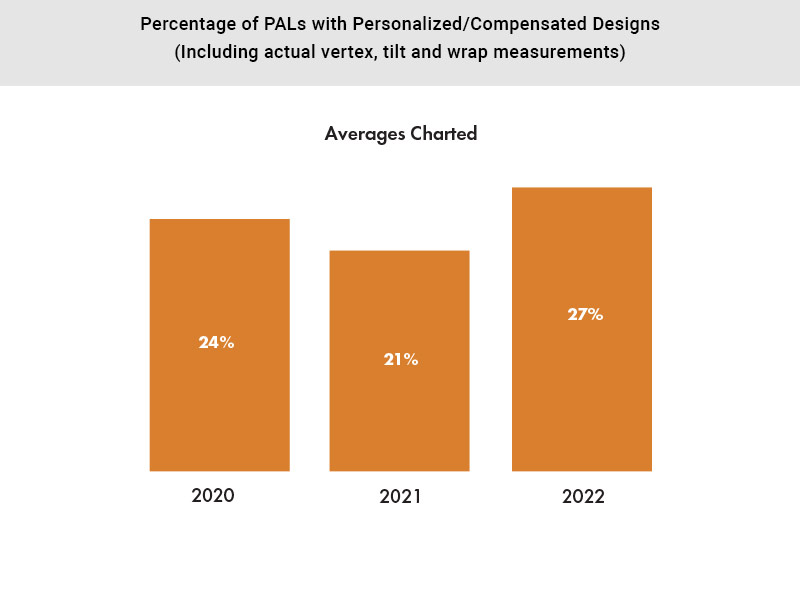

Twenty-seven percent of the progressive lenses with personalized/compensated designs include actual vertex, tilt and wrap measurements.

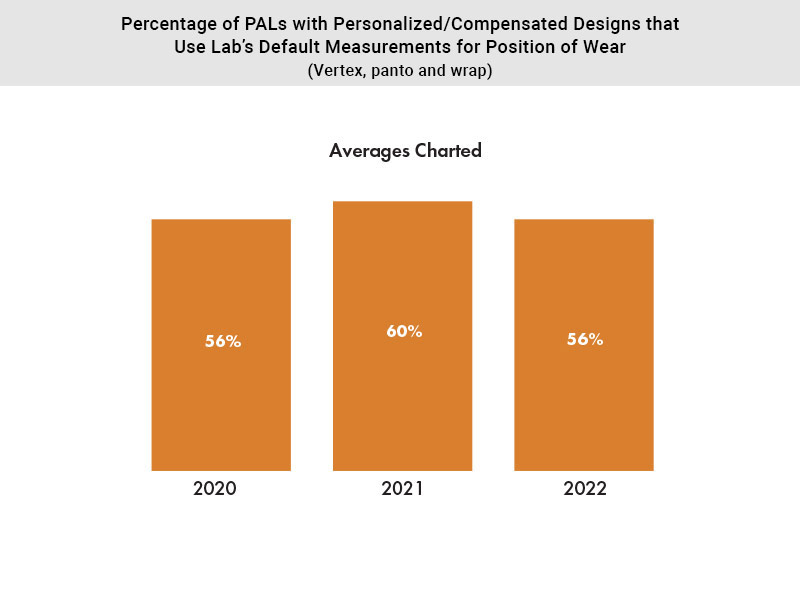

Over half (56 percent) use the manufacturer’s or lab’s default measurements for position of wear (vertex, panto and wrap).

DIGITAL MEASURING DEVICES

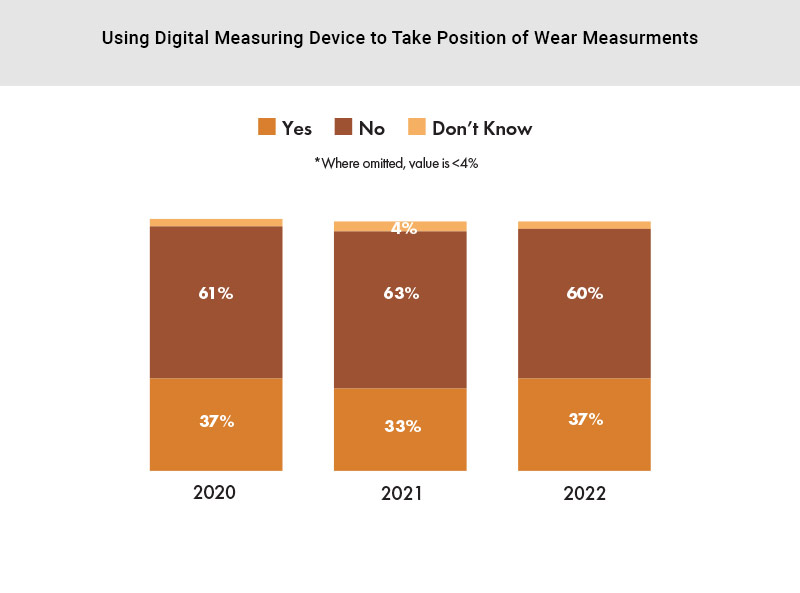

Thirty-seven percent of retailers said that they have a digital measuring device in their office to take position of wear measurements. Among them, 51 percent say they use it 75 percent to 100 percent of the time.

LENS PACKAGES

Fifty-one percent of retailers said that they use package pricing. Eighty percent offer premium, mid-range and value package pricing. The average price of a lens-only package was

$298.48. The most popular feature to include in a lens package is 100 percent UV (68 percent).

OUTDOOR EYEWEAR

Sixty-four percent said they have increased discussions with their patients on the importance of UV and HEV blue light absorbing eyewear for outdoor use, and 56 percent have written more prescriptions for them in the last three years.

METHODOLOGY

This sample was derived from the proprietary Jobson Optical Research database. This survey was conducted by Jobson Optical Research’s in-house research staff. Data collection was conducted in March 2023. ECPs were asked about 2022 sales and performance. Only the responses of independent optical retailers are included in the report. This year’s sample consists of 289 independent optical retailers. All participants were recruited by email and the questionnaire was completed online. Four years of data is provided for comparisons where possible.

–Jennifer Waller, Director of Research & Business Analytics