L&T’s annual Premium Lens MarketPulse Survey provides a useful benchmark for independent eyecare practitioners to compare against their spectacle lens and Rx sun lens sales. The data compiled here based on input from 537 independent optical retailers also sheds light on how these ECPs dispense certain lenses, such as digital progressive and single vision lenses that may require personalized measurements. We’ve included three year comparative data wherever possible to show how sales of various products are trending.

–Andrew Karp

TOTAL SALES

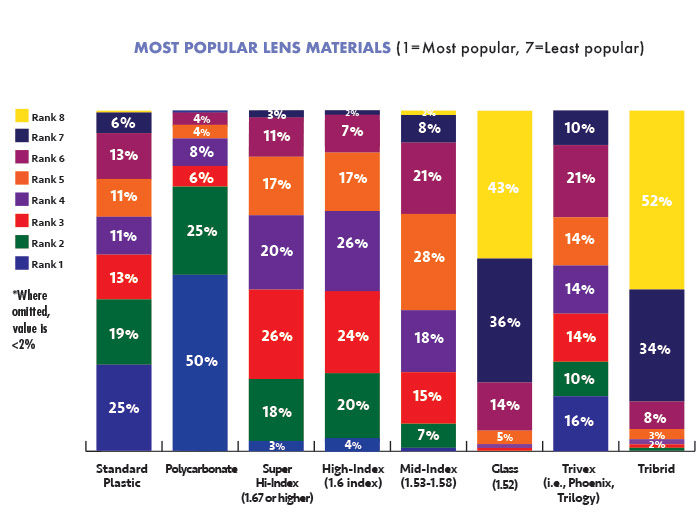

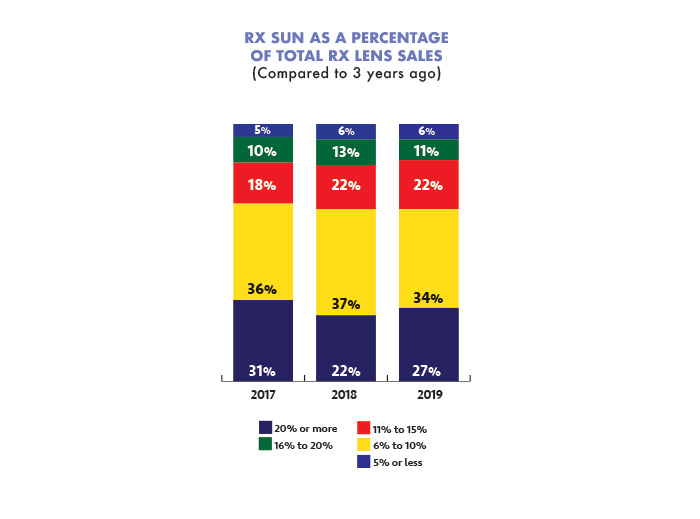

Compared to three years ago, 64 percent of retailers said that spectacle lenses and treatments made up a larger percentage of their location’s total gross dollar sales in 2019. In 2019, 55 percent said pricing on spectacle lenses and treatments has increased compared to three years ago as well, and 43 percent said that Rx sun lenses as a percentage of total dollar sales increased over the same period.

LENS SALES

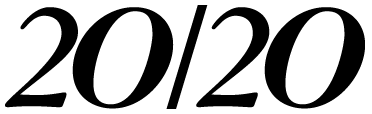

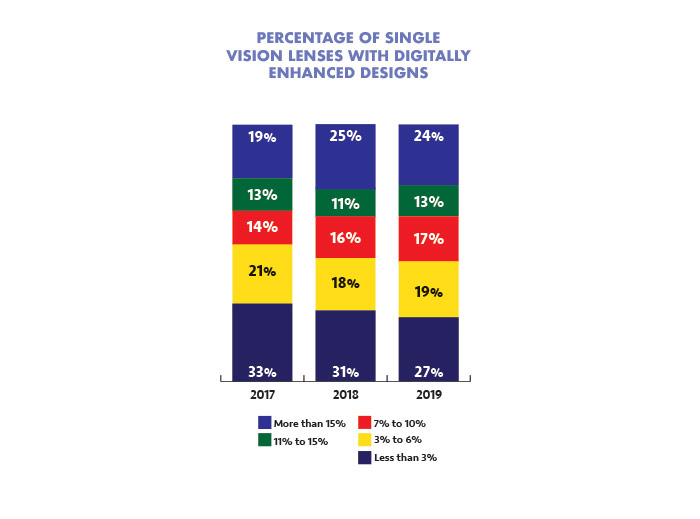

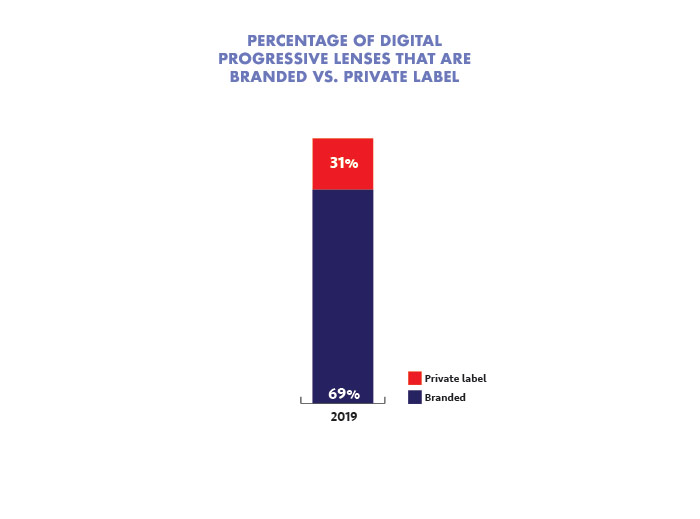

When asked to rank lens design by popularity, standard or aspheric single vision was ranked most popular by 43 percent of retailers. Customized or personalized progressives were ranked most popular by 35 percent. Less than one third of retailers (27 percent) said less than 3 percent of single vision Rxs sold are digitally enhanced. Sixty-five percent of retailers said less than 3 percent of single vision digitally enhanced lenses use actual vertex, tilts and wrap measurements done in the office by the retailer. Close to three fourths (68 percent) of retailers said that customized or personalized progressives lenses made up a greater proportion of their total lens sales in 2019 than they had versus three years ago, and 52 percent said computer/variable focus sales had increased over the last three years, while 28 percent said that sales of bi/trifocals had decreased as a percentage of total lens sales over the last three years, respectively. Seventy-three percent prefer lens manufacturer brands over lab private labels for digital progressive lenses.

COMPUTER/OFFICE LENSES

Almost all retailers surveyed (93 percent) say they determine whether a patient should have computer lenses by their occupation/vocation as opposed to add power.

LENS MATERIALS

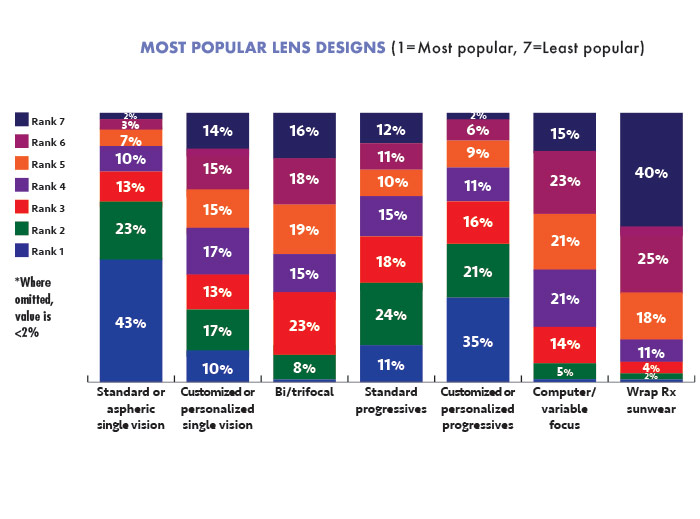

When asked to rank lens material by popularity, polycarbonate was ranked most popular by 50 percent of the retailers. Standard plastic was ranked most popular by 25 percent. Tribrid, the newest material, was ranked least popular by the most retailers (52 percent). Forty-six percent of retailers said their 2019 polycarbonate lens sales increased as a proportion of total lens pair sales compared to one year ago. Forty-four percent and 43 percent said the same about their super high-index and Trivex lenses, respectively. Sixty-seven percent said their mid-index lens sales had stayed flat. Glass was the weakest with 39 percent saying that glass made up a smaller proportion of their total lens sales in 2019 than last year.

LENS TREATMENTS

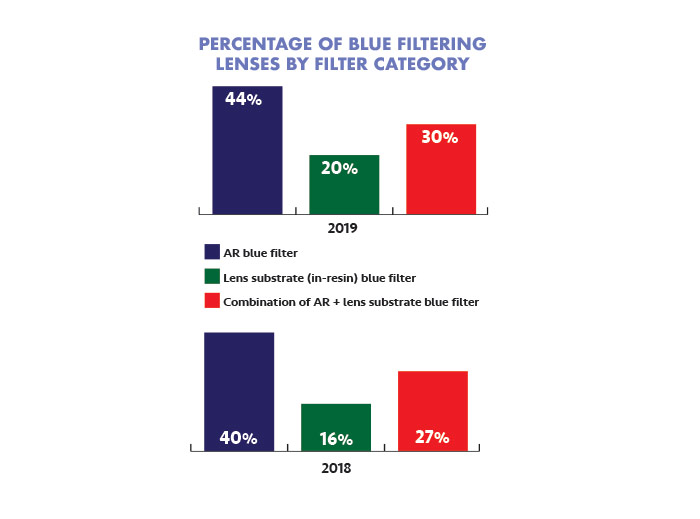

An average of 44 percent of clear blue light filtering lenses are AR blue filter. Twenty percent are lens substrate (in-resin). Thirty percent are combinations.

PERSONALIZED PROGRESSIVES

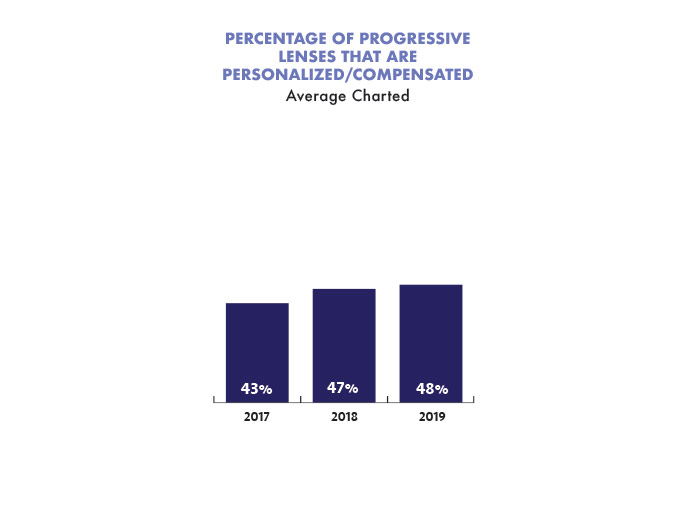

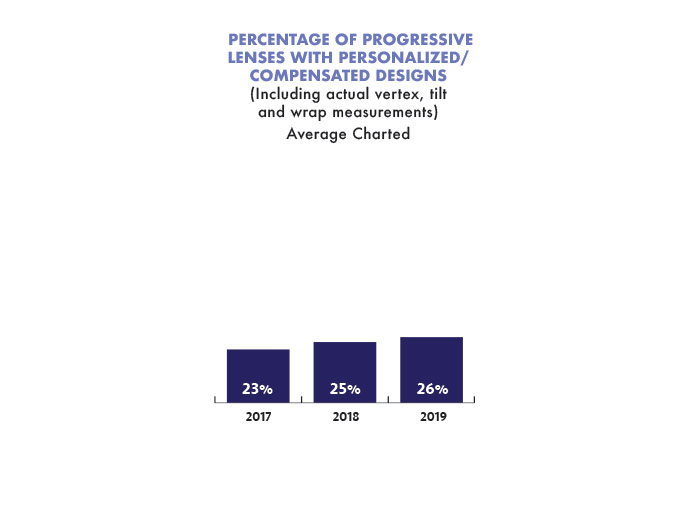

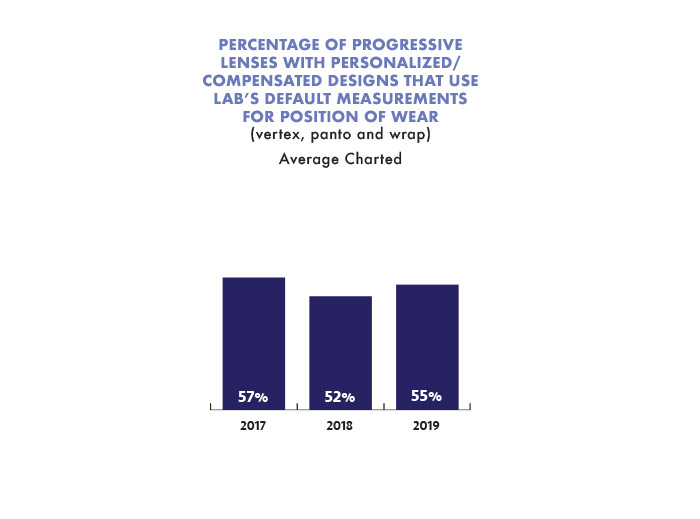

Retailers said that 48 percent of their progressive lens sales are personalized/compensated, on average. Twenty-six percent of the progressive lenses with personalized/compensated designs include actual vertex, tilt and wrap measurements. Over half (55 percent) use the manufacturer’s or lab’s default measurements for position of wear (vertex, panto and wrap).

DIGITAL MEASURING DEVICES

Thirty-seven percent of retailers said they have a digital measuring device in their office to take position of wear measurements. Among them, 52 percent say they use it 75 to 100 percent of the time.

LENS PACKAGES

Fifty-one percent of retailers say they use package pricing. Eighty-two percent offer premium, mid-range and value package pricing. The average price of a lens-only package was $260.85. The most popular feature to include in a lens package is 100 percent UV (68 percent).

OUTDOOR EYEWEAR

Seventy-five percent said they have increased discussions with their patients on the importance of UV and HEV blue light absorbing eyewear for outdoor use, and 66 percent have actually written more Rxs for them in the last three years.

METHODOLOGY

This sample was derived from the proprietary Jobson Optical Research database. This survey was conducted by Jobson Optical Research’s in-house research staff. Data collection was conducted in February 2020. Only the responses of independent optical retailers are included in the report. The 2020 sample consists of 537 independent optical retailers. All participants were recruited by email, and the questionnaire was completed online. Three years of data is provided for comparisons where possible.–Jennifer Waller, 20/20 Research Director